Note: This article was published on April 11, 2025, since that time the nature of trade talks may have changed the situation at hand.

Last week, President Trump implemented a 10% baseline tariff on all imports coming into the U.S., including goat meat from Australia. Historically, the U.S. has been one of the largest importers of Australian goat meat, accounting for 54% of the country’s total goat meat exports.

Prior to the tariff, goat meat was not subject to any duties under the pre-existing Australia–United States Free Trade Agreement. However, the new baseline tariff that went into effect on April 5 currently overrides this agreement.

Meat & Livestock Australia (MLA)—Australia’s comparable counterpart to the USDA—has indicated that the tariff is not expected to significantly impact exports of Australian red meat (beef, lamb, and goat) to the U.S.

According to the MLA, “The U.S. consumer demand for Australian (meat) is expected to remain strong despite the tariffs.”

And I suspect that will likely be the case (see my additional commentary later in the article).

Historical Export Growth into the U.S.

The U.S. is Australia’s largest export market for goat meat, making up 54% of total exports. In 2024, the U.S. imported 24,867 U.S. tons of goat meat, worth roughly $117.7 million USD (MLA).

Australia has consistently met the growing U.S. demand, with domestic goat production in 2024 jumping 23% compared to the previous year—totaling 2.55 million goats processed. Most of the exported goat meat is frozen and shipped as a carcass (whole or six-way split), with the skin on or off depending on the market. As mentioned earlier, the U.S. represents the highest volume of goat meat exports to a single market for Australia (MLA).

Learn more about the Australian goat meat market in more depth in this article.

Current U.S. Goat Meat Markets

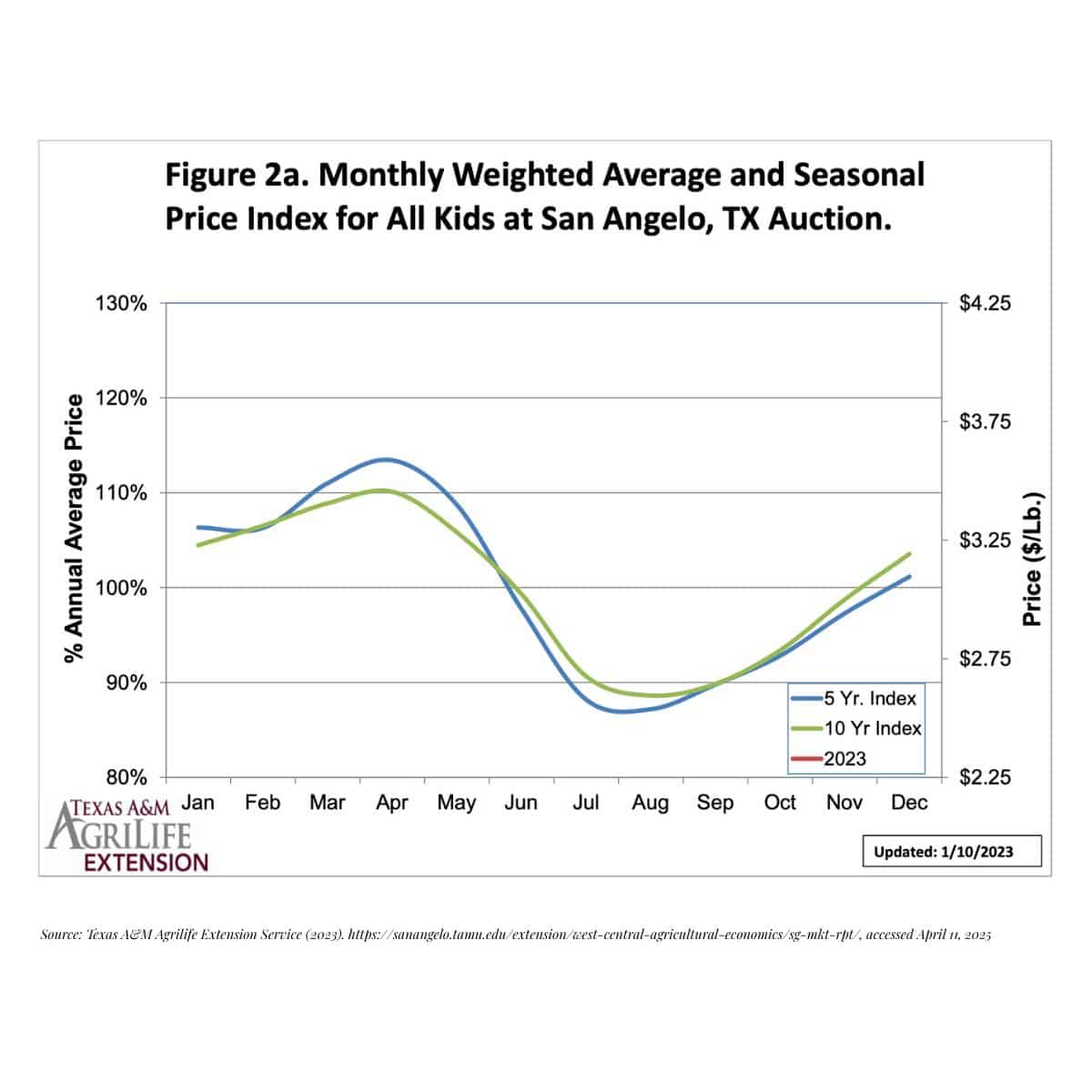

U.S. goat market prices have been trending higher, which is typical for this time of year (see historical trend chart), based on reports from the Texas A&M AgriLife Extension Service.

Due to the large number of goats raised in Texas, market trends from that region are often loosely used as a general benchmark for the broader U.S. goat meat market. It’s worth noting that meat goat markets are not tracked as extensively by the USDA compared to other animal proteins.

The current strong market is due to a limited supply of kids available for sale, largely because goats are seasonal breeders. As a result, market-ready goats tend to become available around the same time each year.

Texas A&M AgriLife (2025) provides the following benchmark prices for goats:

- $3.50/pound = Strong

- $4/pound or higher = Highly variable

- $2/pound = Price slump with higher supplies

Impact of Tariffs on the U.S. Goat Meat Industry

Based on historical data and trends in our domestic meat goat markets, goat meat imports, consumer preferences, and the current international trade climate and the U.S. economy, here’s my assessment of what this means for goat meat in the U.S.:

- Demand for Australian goat meat imports will remain strong. As MLA noted, the U.S. meat goat industry cannot meet current domestic demand.

- Imported goat meat will cost more. However, the price gap between imported and domestic goat meat is already wide. Even with the tariff, imported meat will likely remain less expensive than domestic goat meat, meaning it won’t be easily replaced with U.S.-raised goat meat.

- Economic downturns may have a greater impact. If the U.S. economy enters a recession, as some economists are predicting, demand for goat meat—both domestic and imported—could decline.

Why a downturn all around? Because when our economy is in a recession, or a dip, that means families start to evaluate their purchasing decisions and look for ways to save money and make their dollar go further. Typically, food purchases and entertainment go first. So that means not going out to eat, traveling or taking in other forms of entertainment that require cash.

This trend will likely impact Australian goat meat imports since restaurants, hotels and other entertainment venues will see a drop in use. And, the majority of Australian goat goes into the food service industry in the U.S. Either retail buyers will reduce how much goat they purchase, replace it with a different protein priced at a lower price, or just forego the purchase. It is very unlikely that domestic/U.S. goat meat will replace this market.

Domestic goat meat sales may also slow. The downturn will likely impact our U.S. goat meat supply, as families will take the same approach with their purchasing decisions for managing their budget and meals at home. Goat may be purchased less frequently, substituted with another protein at a lower price, or not purchased at all.

Only time will tell how the full market implications will unfold. I’d love to hear your thoughts—drop them in the comments below.

References:

- Meat & Livestock Australia. (2025). United States tariffs on Australian red meat: Your questions answered.

- Meat & Livestock Australia. (2025). Australia’s 2024 goatmeat boom.

- Texas A&M Agrilife. (2025). Texas sheep and goat prices raise as supply tightens. Agrilife Today.

- Texas A&M Agrilife Research and Extension. Seasonal Price Index for San Angelo Kids. Sheep & Goat Market Reports.

LEAVE A COMMENT

Comments